Let’s analyze now the Double Bottom Pattern, another Pattern of the technical analysis. The Double Bottom is a Reversal Pattern. Let’s analyze it point by point. Remember, that in order to understand better the Patterns of the technical analysis, you should know how the Trend Lines and Resistances/Supports work (For this reason we suggest you to read: What is a Trend and what are Trend Lines; Resistance and Supports).

Features of Double Bottom Pattern

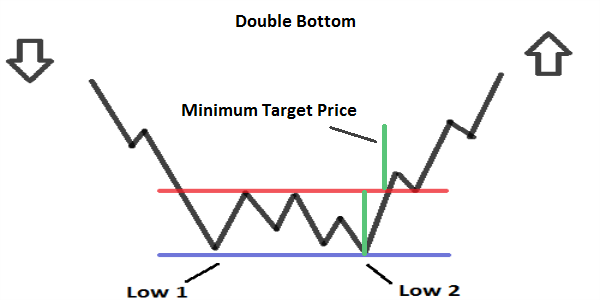

– Pattern composed by: two Lows that reach the same level.

– Located in a downtrend; the longer the trend is, the more reliable the Pattern is (if it lasts for months it’s better).

– First Low (1): must be the Lowest Low of the current Downtrend. Immediately after the Low there is a rise so the Prices must rise of (at least) the 10% of the value of the price compared to the first Low (1).

– Subsequently, there is a period of “ranging” prices, where prices begin to oscillate but they remain at the same level (In a certain range).

– The Second Low (2): must be at the same level of the Previous Low (1) (or there is a slight deviation of not more than 3% of the price of the Previous Low). The period of time between a Low and the other, varies from a few weeks up to several months (usually is 1-3 months and it’s better if the period of time is greater than 1 month, for the long-term Patterns).

– The rise that begins after the Second Low (2), should have High volumes.

– Break of the Resistance: once that the prices break above (Go from below to above) the Resistance, the Pattern is completed (There should be an increase in volumes). The Broken Resistance, now becomes a Support (that can sometimes be tested by prices, before continuing the rise).

– Minimum Price Target: you have to measure the distance between the Resistance and one of the two Lows, and then project it from the break of the Resistance (Resistance that you plot from the Highest High that there is in the period of “ranging” prices ).

![Binance Review: How the Crypto Exchange Works [2024]](https://www.feedroll.com/wp-content/uploads/2024/03/binance-trading-100x100.png)