eToro is one of the most important brokers of social trading and CopyTrader functions, which allows you to copy the investments of other traders.

More than just a CFD broker, with eToro it’s possible not only to trade CFDs, but also to buy shares. The possibility of using the broker as a traditional social and the possibility of copying the best traders, make this platform one of the most widely used in the world.

In this guide on how eToro works, we will introduce the features of the broker and we will understand how to trade on eToro. We will describe the markets section and the CopyTrading section, and then review the various platforms available. The aim is to understand whether this broker can be included in the list of the best brokers and whether trading with eToro pays off.

Before going into the details of the guide, we would like to highlight a very important aspect: the possibility to trade stocks online without commissions. For those who usually invest in the stock market, this is a great opportunity that can also be taken advantage of very easily as the minimum initial deposit required to trade is very low: just $50!

eToro Social Trading

Social trading runs counter to the philosophy behind the very concept of online trading. By definition, Forex, stocks, commodities are all individual markets. Whoever chooses to invest in the online stock market is, in fact, alone with his or her own device and trading platform.

The vast majority of brokers do not provide space for interaction between users. eToro’s philosophy is completely different: the broker’s stated objective is to create the conditions for a community of traders to develop.

By logging in, even in demo mode, and clicking on any asset, a page will open with all the comments from users interested in that market or who have already invested in that market. At eToro, anyone can read and write comments as well as request a friendship and thus make ‘private’ contact with other members. eToro social trading works just like a social network!

>>> Open a trading account at eToro <<<

eToro Markets

The assets available to trade at eToro are the classic assets of a trading broker. With eToro you can trade CFDs on the following markets:

- Shares

- Currencies

- Cryptocurrencies

- commodities (natural gas, oil and some precious metals)

- stock market indices

- ETFs (Exchanged Trades Funds).

- Copy Portfolio

Thanks to eToro’s market movers you can find out which markets are the most volatile. We also specify that you can buy shares and cryptocurrencies. By selecting a buy position with a leverage of 1:1 (i.e. without leverage) the trader will be buying the traded asset.

Of the various markets available, the one that eToro’s management has been focusing on most recently is cryptocurrencies. In the beginning it was only possible to trade on eToro via CFDs on cryptocurrencies such as BTC/USD, but today it is possible to buy Bitcoin and many other cryptocurrencies: eToro today offers a complete experience for trading in many crypto-assets!

To discover all the features of a multi-functional cryptocurrency broker like eToro all you have to do is follow the image below.

eToro Spreads and Commissions

One of the most interesting pieces of information for a trader concerns costs, spreads and commissions. On this aspect, eToro’s offer is very clear!

eToro’s decision to keep its distance when it comes to determining trading spreads and commissions stems from a very specific practical reason. By its very nature, the spread tends to vary depending on market conditions and available liquidity. Precisely for this reason, there may be particular times when, due to market conditions, spreads may widen compared to the values indicated by eToro for each asset.

To avoid any surprises, the best thing to do is to be very careful when opening a trade: in general, eToro’s spreads range between 3 and 4 pips and are in the top tier of the best spreads offered by trading platforms at the same level as eToro.

>>> Open a trading account at eToro <<<

Social Trading eToro

As we have already mentioned eToro aims to create a community of trading experts and so it is in this context that the role of the People section should be framed.

There are two functions of this section: to find friends, as in a real social network, and to have a practical tool for trading by simply copying the choices of those you consider to be the best traders on eToro.

The amount of information you have access to by clicking on People is remarkable. First of all, thanks to some very accurate filters (two are the most important criteria: Country of the trader and prevailing assets of his investment) it is possible to select the best traders for our purpose.

How CopyTrading works at eToro

The step from People to CopyTrading is a short one: CopyTrading eToro is a tool that allows you to replicate the strategy of other traders and thus gain (if the strategy brings a profit) and lose (if the strategy brings a failure).

This very simple answer definition that is often given to the question how eToro Copy Trading works has led to quite a few misunderstandings. Many novice traders, in fact, have thought they were using copy trading on eToro to try and make money with minimal effort. This approach is completely wrong!

Copy trading, in fact, is not a game and even copying requires a fairly high level of preparation. It must be remembered that it is not eToro that indicates the best traders to copy, but instead it is the investors themselves who have to find them.

The broker merely makes available a whole series of tools but their management is up to the individual investor. In short, the user must be good at finding the best traders on eToro. Among the many filters that can be used to search are:

- Number of copiers

- Profit

- Profitable months

- Profitable investments

- Risk Score

- Daily Drawdown

- Weekly Drawdown

- Allocation

- Average size

- Exposure

- Active weeks

- Investments

By setting all of the filters in the list, you can get a not inconsiderable amount of useful information for choosing the best eToro traders!

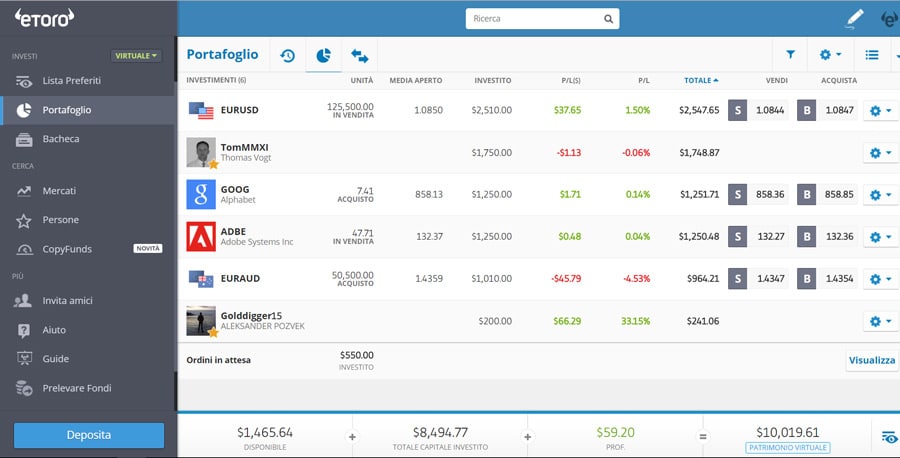

eToro Demo Account

Learning how to use the filters we mentioned in the previous paragraph takes time and practice: it’s more difficult to learn how to copy the best trading strategies on eToro than to understand how to trade in the traditional way!

It is for this reason that switching to the demo account is highly recommended: the demo account that the broker makes available to all its users mirrors the characteristics of the real account.

Therefore, by opening an eToro demo account (very few steps are required) you have all the functions and tools of the real account at your disposal. This means that you can consult charts, work out trading strategies and even copy the moves of more experienced traders. The eToro demo account can be used without time limits.

You can therefore try eToro with a free demo account. In a few minutes you will have your own test account, where you will be credited with $100,000 virtual money that will be useful for doing all the simulations you need on all the assets on the platform.

Open a trading account at eToro

Real account at eToro

Switching from your eToro demo account to your real account is done after formal authentication. When you open a real account to trade on eToro, therefore, you need to scan a personal identification document. However, the procedure is quite fast and in line with that of other brokers.

One question that an investor is often led to ask is whether it is possible to switch from the real account to the demo account. One of the great advantages of eToro concerns precisely this point. With each login, one can operate in demo mode or with real money!

Minimum deposit at eToro

In order to open a real account at eToro, it is of course necessary to deposit a minimum amount. Once upon a time, this requirement was not necessary but is now adopted by practically all brokers to discourage those who sign up for the trading platform just for fun.

The minimum deposit at eToro is $50.

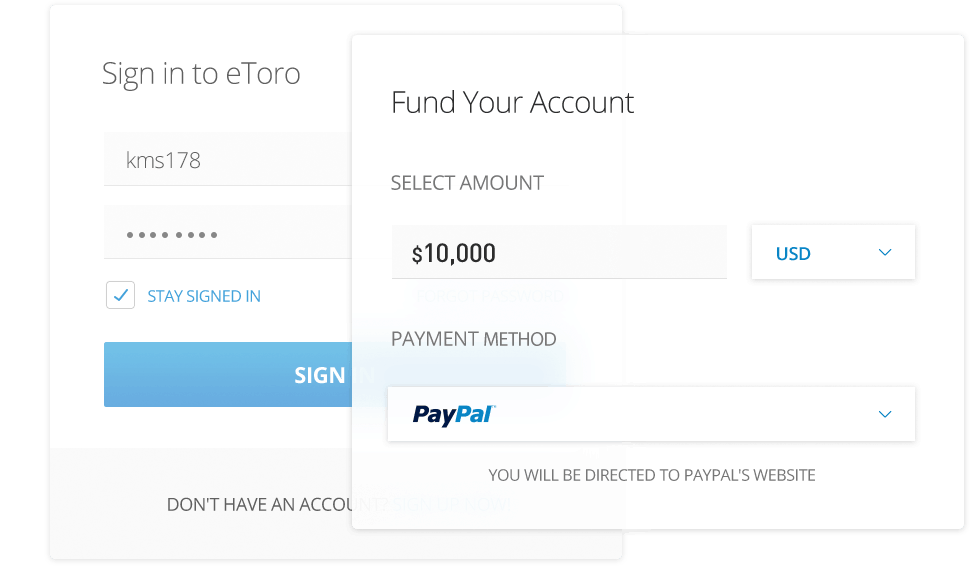

How to Deposit Money at eToro

Before opening a demo account at eToro, it is useful to understand what the mechanism is for depositing. As far as depositing is concerned, opinions on eToro are all positive and insist on the extreme simplicity of handling this step. Depositing funds into your eToro account is very simple because you can choose from many means of payment!

You can deposit funds to your eToro account through credit cards (Visa, Mastercard), Giropay, Neteller, Skrill Limited UK, WebMoney, Bank Transfer and PayPal.

How to withdraw from your eToro account

Withdrawing from your eToro account is also very simple. Depending on the payment system, it takes from a few hours to a few days. We believe that it is important to point out in an eToro review that your money is always safe. There are no risks. The funds are withdrawn via the same payment method and transferred to the same account used for the deposit. The minimum amount that can be withdrawn at eToro is €20. eToro charges a fixed withdrawal fee of $5 USD.

eToro Trading Academy

For a broker who aims to build a real community of traders, training is a very important aspect. This is precisely why eToro has created the Trading Academy, a kind of permanent laboratory that offers a wide range of learning tools such as videos, guides and webinars as well as simple and affordable tips for everyone.

The training tools made available free of charge by eToro are aimed at both experienced traders and beginners. The aim of the training tools is not only to provide insights into concrete strategies but also to educate on the potential of social trading.

Advantages and disadvantages of eToro

Establishing the advantages and disadvantages of eToro is not easy, also because it is necessary to understand with which brokers eToro can be compared. When it comes to social trading, eToro’s unique platform is unmatched. All other brokers who offer a social approach but are many after this platform cannot compete with what was their inspiration.

Having clarified this among the advantages of eToro we include:

- unique platform

- easy demo account opening

- copy trading function

- quantity of assets available

- spreads at the lowest levels in the market

- minimum deposit within everyone’s reach

As far as the disadvantages of eToro are concerned, our only objection is the absence of the MT4 platform. For many traders, MetaTrader 4 is an indispensable reference point and, for this very reason, opinions on eToro suffer from the absence of MT4.

![Dukascopy Broker Reviews, Pros & Cons [2024]](https://www.feedroll.com/wp-content/uploads/2024/03/Dukascopy-europe-450x338.jpg)

![Plus500 Reviews: How it Works, Pros & Cons! [2024]](https://www.feedroll.com/wp-content/uploads/2024/03/plus500_-450x338.jpg)

![Binance Review: How the Crypto Exchange Works [2024]](https://www.feedroll.com/wp-content/uploads/2024/03/binance-trading-100x100.png)