Binary Options Trading

The Binary Options are the easiest financial instrument available nowadays, that is becoming more and more popular everyday that passes. In fact there are more and more Traders, professional Traders and new Traders, that decide to invest on Binary Options. The why is easily explained: Binary Options are the easiest and most flexible financial instrument ever.

As the name itself suggests (“Binary”), with the Binary Options you will have to make a choice, to take a decision. The only possible outcomes of a Binary Options are two, therefore you have to choose between the first one and the second one. It means that even if you don’t know what a Binary Option is, and how Binary Options work, you will already have the 50% of chances to take the right decision.

But what do you get when you make the right choice? Easy: profits. Yes, because Binary Options are a financial instrument and thus, you will have to invest on them. You are the one that decide the amount of money invested (You can start with only 10 EUR or 10$ for example): this amount depends on different factors of course. Firstly how much money you can afford to invest (One golden rule, in all the types of investment is to never invest an amount that you can’t afford to lose) and then on your Money Management Plan for your Trading Activity.

But let’s start with the basics of the Binary Options Trading. Now we will show you what are the features of a Binary Option.

Binary Options Tips and Features: What are Binary Options and how they work

Now that you have understood what are Binary Options, we must analyse the features of the Binary Options. With the Binary Options you have to make a choice between two different possibilities. But what are these two possibilities?

You will have to make a prediction on the price movements of an Asset within a period of time (That is called Expiry Time or Expiration Time). As we said before, the possibilities are two: this because the price of an Asset can increase or decrease. If for example the value of the Google’s Shares is $80.50, the price can surely change and it can be higher or lower. Therefore with the Binary Options you only have to choose if the price will be higher or lower. Pretty simple to understand for everyone.

Whereas an Asset, is the underlying instrument of the Binary Option: normally they are currency pairs, commodities, stocks and stock indexes. When trading Binary Options, you are the one that choose the Asset depending on your market analysis and on the type of Asset that you prefer. For example, a Trader that used to trade Stocks would probably choose for Stocks Assets with the Binary Options too. The decision of the Asset can be done on your market analysis too: you will have to read the chart of the price of an Asset and then decide if you should invest on that Asset or not.

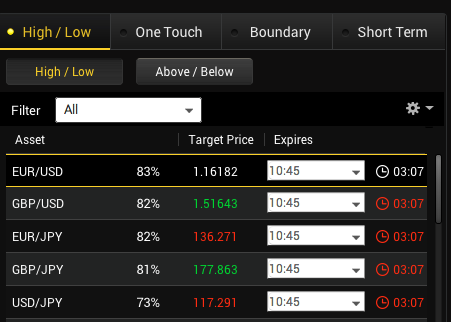

Lastly we have to consider the Expiry Time: in this case too, you are the one that decide the best Expiry Time for your Binary Option. There are different Expiry Times: from 30″ up to 1 day or even 1 week. The most used Expiry Times by Traders are:

- 60″

- 5 Minutes

- 15 Minutes

- 1 Hour

- 1 Day

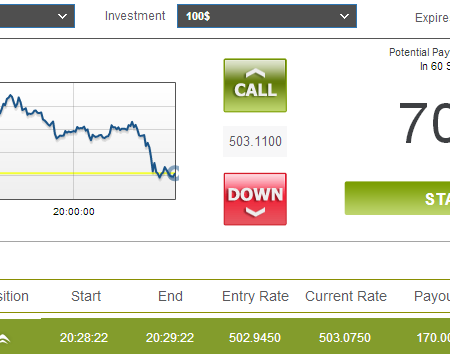

Binary Options Platform and Payouts

At this point we must introduce the Payouts of the Binary Options. Because in case that your prediction on the price movement of an Asset will be correct, you will gain some nice profits (Called Payout). Whereas in case that the prediction will be wrong, you will lose the money invested on the Binary Option. Although sometimes you will receive a kind of “refund” on your investment. The Payout is a return on the investment done: for example if the Payout is 80%, it means that you will earn the 80% of the capital invested on the Binary Options. Thus if you invest 100 EUR or $100, you will earn 80 EUR or $80 (The total would be 180 EUR or $180: the amount invested + the profits).

The Payout depends on:

- The Type of the Binary Option: there are different types of Binary Options, such as the High/Low Binary Options (Known as Call/Put Binary Options), the One Touch Binary Options, the Range Binary Options and the 60″ Binary Options. Each Option works in a different way.

- The Asset: there are four groups of Assets (Currency Pairs, Stocks, Commodities, Stocks Indexes). The Payout will change depending on the Asset chosen.

- The Expiry Time: it can change the payout too, depending on the one that has been chosen.

However normally, the average Payouts for the High/Low Binary Options (The one where you have to predict a raise or a fall in prices) is around the 70% up to 90%. Higher Payouts can be found with the other types of Binary Options such as the One Touch Binary Option: here the Payouts can reach the 200-300%.

But the most important thing with the Payouts, is that you will know them since the beginning. Even before investing on a Binary Options your money. That’s right. You will always know how much you could earn, and how much you could lose with Binary Options. This one of the most important advantage of this financial instrument, that you will never find with other types of investment. In fact with the Stocks Trading, you can’t know how much you can earn: it depends on the variation of the prices of the Stocks bought. Whereas with Binary Options yes, you can know both the potential profit and the potential loss.

Binary Options Brokers

But how can you invest on Binary Options? Simple: you need an account with a Binary Options Broker. Today, there are countless Binary Options Brokers available on Internet. In fact all the Binary Options Brokers work online: they have a website, and a Trading Platform. You don’t even have to download the Trading Platform because is a web-based Platform, therefore it won’t slow down your computer.

Opening an account with a Binary Options Broker is pretty simple and after that, you will have to make your first deposit: said in other words, you will have to deposit an amount of money that you’d like to invest on Binary Options. Usually Binary Options Brokers have a minimum amount that can be deposited: it depends on the Broker that you will choose, but the average is around 100 EUR – 200 EUR or $100 – $200. Of course, you should find a Broker that suits your needs: the amount deposited, should be an amount that you can afford to lose.

Moreover, each Broker has different features and services: check carefully a Broker before decide to invest your money with them. And be sure to choose a Regulated Broker: because it’s possible to find Brokers without regulations too, also known as “Scam Brokers”.

Binary Options Trading: an Example

Let’s conclude our Article with a concrete example of Trading with Binary Options, so that you can understand how Binary Options work.

Trading Example:

- The Asset: as first thing we must choose an Asset for our Binary Option. In our example, we will choose the Amazon’s Shares because thanks to our markets analysis we predict a raise in the prices. The price of the Asset is $87.88 for share.

- The Binary Option Type: now we can choose the type of Binary Option that suits better our prediction. In this case, we decide for the High/Low Binary Option.

- The Expiry Time: in this case we are going to choose the 1 hour Expiry Time, decision based on our market analysis.

- Amount Invested: Sure of our prediction, we want to invest 100 EUR on this Binary Option.

- The Forecast or Prediction: As already said before, we will choose the “Call” Option because we think that there will be a raise in prices within the next hour in the Amazon’s Shares.

- Confirming the Binary Option: at this point, we only have to check that everything is okay and that we didn’t make a mistake while selecting the different features. We will know the Payout too: 80% in this case.

What’s next? Nothing else: after that we have bought the Binary Option we will have to wait the Expiry Time, 1 hour in this case. These are the possible outcomes at this point:

- A) The prediction was right: after 1 hour, the price of the Amazon’s Shares is greater. Let’s say $88.24. Therefore our prediction was right and we will earn the Payout: 180 EUR.

- B) The prediction was wrong: after 1 hour, the price of the Amazon’s Shares is lower. Let’s say $87.35. Therefore our prediction was wrong and we will take a loss: 100 EUR. Although some Brokers may offer a refund, that is around the 10-15%.

One last aspect that we should underline with Binary Options, is that the variation of the price of the Asset is the key point. It doesn’t matter how much the price changes: the only thing that matters is that changes, even for just 1 decimal point. For example, in case that the Amazon’s Shares increase in value from $87.88 to $87.89 (Just $00.01 of variation) and we had chosen a Call Binary Options (Thus we had predicted a raise), we would have won the Binary Options and the related profits.

For insights on the world of binary options we suggest:

– http://www.dailyforex.com/binary-options – English guide

– http://www.meteofinanza.com/opzioni-binarie/ – Italian Finance portal since 2006

Binary Options Straddle Strategy

Having a Binary Options Strategy is one of the most crucial thing: it’s essential if you’d like to earn profits, and not losses. In fact, the Binary Options as all the other financial instruments available for Traders, are not gambling. Always remember that Trading is like a Job: no matter what you are gonna trade (Stocks, Currency Pairs with the Forex Market, CFDs and so forth), you must take it seriously. Specially because when Trading you’re risking your money, not the money of other people (Unless you are a Bank, of course). It means that if you trade without a logic, therefore without a Strategy, you will surely lose your money.

In our case, the Binary Options, we have an edge on the financial markets: in fact even if you don’t know anything about Binary Options, you will have a 50% of chances to win your Trades. It’s difficult to find another financial instrument like Binary Options, that has the same features. Because not only you will have the 50% of chances (Like when you toss a coin), but you will always know since the beginning how much you could earn and how much you could lose. It’s quite different from trading with Stocks or trading with currency pairs in the Forex market: even before investing the money, you will know your potential profits and potential losses.

Whereas in the Forex Market and in the Stocks Market, your potential profits will remain unknown to you until the end of the trade. Your profits will entirely depend on the variation of the prices of the selected Asset. With the Binary Options you will know the “Payout” (A.k.a. The profits, the return on the investment done): that is a percentage on the investment made on a Binary Option. For example, the average Payout is around the 70-90% of the capital invested; thus if the Payout for a Binary Option is 80% if you invest 100 EUR or $100, your profits will be 180 EUR or $180.

WHAT IS A BINARY OPTIONS STRATEGY

Now, let’s dive into the “middle of the action”. As we’ve stated above, having a strategy is essential, is vital, when trading with a financial instrument, Binary Options included. It’s true that you will have the 50% of chances since the beginning, and that the risk is fixed but why not increasing the percentage of success to the 70-80% or even more? The greater the percentage of success, the greater your chances of earning profits (And not losses).

For this reason, everyone should use a proper strategy to Trade Binary Options. Using a strategy, will improve your Trading Activity without doubts and you will avoid heavy losses. All the strategies crafted for Trading, are based on a simple golden rule: increasing the profits, cutting the losses. A simple but very effective rule that will save you from countless losses and headaches. It doesn’t matter what strategy you will use, but you must use at least one strategy and be always sticked to it. Every strategy has its own set of rules, that you must follow: otherwise why are you using a strategy?

If you are a “beginner” in the world of Trading, you should start with a simple strategy. Find one or two strategies that suits your needs, test them and then choose the best one. Always try a strategy before you start using it with your money: backtesting is the key and by doing this, you will be able to improve the strategy too.

So, let’s sum up the main features of a strategy:

- Based on the golden rule: increasing profits, cutting losses

- Always test a strategy, if possible without using your money (A Demo Account would be perfect)

- A strategy can always be improved through some good backtesting

- Start with one Strategy, specially if you are a novice Trader

- You can even create your personal strategy, after that you’ve learned the basics

- A strategy normally is composed by Indicators and Oscillators, and Technical Patterns

- You can even buy Strategies if you’d like: but be always sure that it was backtested and that it works

BINARY OPTIONS STRADDLE STRATEGY

Now that you’ve understood what a Binary Options Strategy is, we can now introduce and explain what is the Binary Options Straddle Strategy. This type of Strategy, is one of the easiest that you can use for Trading the Binary Options. In fact is one of the most used strategy by novice Traders, because it’s simple to understand and easy to apply.

The Straddle strategy is a way to increase the chances of success of your operations with the Binary Options. It’s a way to both increase the profits and cutting the losses. This because normally, when you invest on a Binary Option you can only choose one direction for the price of the Asset: Up or Down (Of course, this strategy must be used with the High/Low Binary Options, also known as Call/Put Binary Options).

Therefore the price of the Asset must move in the right direction, the one that you’ve chosen before. If I believe in a raise in prices, I will select the “Call” Binary Option: of course, I will earn the Payout only and only if my prediction will be right (If the price of the Asset will increase after the Expiry Time). Otherwise, I will lose the money invested on the Binary Option.

Here’s where the Straddle Strategy works: using this Strategy, you could cover both directions (Up & Down, the raise and the fall in prices). Although you cannot select both Put and Call Option in a single trade, you can cover both side of the market using this strategy.

Said in other words, to “straddle” means to cover both sides. In our case, both movements of the price of an Asset: up and down. Therefore you will need to buy 2 different Binary Options, related to the same Asset but with a different prediction for the price movement. Here’s the trick: by doing this, one of the Option will always be a profitable trade. In fact, if for example the price of an Asset (Let’s say Apple’s Shares) is $95.00, the price after the Expiry Time (1 hour for example) could be higher (As $95.78) or lower ($94.65). It means that you will always earn a profit, no matter what.

But of course, you have to choose carefully the Expiry Time of the two different Binary Options: here’s lying the key of success for this Strategy. You can’t choose the same Expiry Time for both Options: otherwise, you will lose money. Why? Because the Payout for a Binary Option, is always under the 100% of the amount invested: normally the average for the High/Low Binary Option is 70-90%. Thus, if I invest 100 EUR, I will earn as profits from 70 EUR up to 90 EUR (Plus the 100 EUR invested at the beginning). And you can easily understand, that if you invest 100 EUR on a Call Binary Option and 100 EUR on a Put Binary Option, only one of the two Options will be successful and therefore you will earn only one Payout (That it would be, in case that the Payout is 80%, 80 EUR). So:

- The Call Binary Option is successful: +80 EUR

- The Put Binary Options is not successful: -100 EUR

This is an example: it can be the opposite too (The Put as successful, the Call as not successful). But the concept is the same: you will have a loss of 20 EUR.

So, how can we properly use the Straddle Strategy?

The answer is easy, more than you could imagine. The most important thing is that you have, or better saying must, choose two different Expiry Times. For example, you can choose for the first Binary Option an Expiry Time like 30 Minutes. Whereas for the second Binary Option an Expiry time of 15 Minutes. Of course, the two Binary Options must reflect two different predictions: Call and Put (Raise and Fall in prices).

Normally you have to invest more on the Binary Option with higher chances of success. While, for the Second Binary Option (That we repeat again: you must open with a different Expiry Time and in a different moment, not just immediately after the first one) that has less chances of success (But has still few chances), a smaller amount. In this way, the profits of the First Binary Option will cover the potential loss of the Second Binary Option.

An example:

- First Binary Option: A Call Binary Option with a Payout of 80%. Amount invested: 100 EUR.

- Second Binary Option: A Put Binary Option with a Payout of 75%. Amount invested: 50 EUR.

These are the possible outcomes:

- The Straddle Strategy succeeds: both Options are successful. 80 EUR from the first Payout + 37.50 EUR from the second Payout. Total = + 117.50 EUR.

- The Straddle Strategy doesn’t succeed: the first Option is successful, the second one not. 80 EUR from the first Payout – 50 EUR of loss from the Second Binary Option. Total = + 30.00 EUR.

Of course, you must read the charts and analyse the price movements: you can’t just toss a coin and then choose an Expiry Time for both Options. Otherwise the Strategy wont’ be profitable. This Strategy is especially used to speculate on short price movements within a Trend: for example, if the Primary Trend is an Uptrend you can invest on a Call Binary Option for the long-term. Whereas you can speculate on the short variation in prices, such short downtrends, by investing on Put Options.

For other binary option strategy for beginners we reccomend:

– http://www.investopedia.com/active-trading/options-and-futures/ – English

– http://www.meteofinanza.com/strategie-opzioni-binarie/ – Italian – online since 2006

![Binance Review: How the Crypto Exchange Works [2024]](https://www.feedroll.com/wp-content/uploads/2024/03/binance-trading-100x100.png)