Let’s analyse now the Triple Top Pattern, another Pattern of the technical analysis. The Triple Top is a Reversal Pattern. Let’s analyze it point by point. Remember, that in order to understand better the Pattern of the technical analysis, you should know how the Trend Lines and Resistances/Supports work (For this reason we suggest you to read: What is a Trend and what are Trend Lines; Resistance and Supports).

Features of the Triple Top Pattern

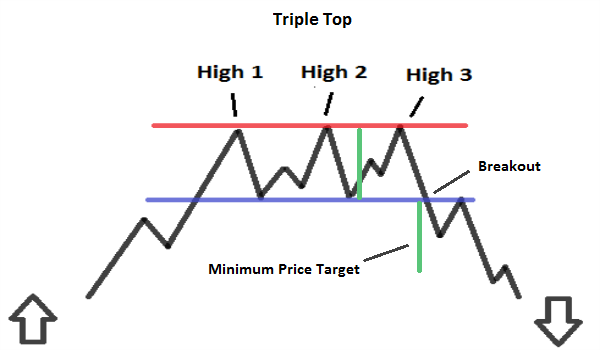

– Pattern composed by: three Highs that reach the same level.

– Located in an uptrend; the longer the trend is, the more reliable the Pattern is (if it lasts for months it’s better).

– The three Highs: must be at the same level, more or less (It’s possible a slight deviation of not more than 3% of the price of the Previous High).

– The volumes of trades: they should be decreasing during the formation of the Pattern; sometimes the volumes rise close to Three Highs of the Pattern. After the third High, when there is the decline (3) and when there is the break of the Support, there is an increase in volumes.

– Break of the Support: once that the prices break below (Go from above to below) the Support, the Pattern is completed (There should be an increase in volumes). The Broken Support, now becomes a Resistance (that can sometimes be tested by prices, before continuing the decline).

– Minimum Price Target: you have to measure the distance between the support and one of the three Highs, and then project it from the break of the Support (Support that you plot from the Lowest Low that there is during the formation of the Pattern ).

![Binance Review: How the Crypto Exchange Works [2024]](https://www.feedroll.com/wp-content/uploads/2024/03/binance-trading-100x100.png)