Let’s analyze the Broadening Formation, another Pattern of the technical analysis. The Broadening Formation is a Pattern of reversal or continuation of the Trend. Let’s analyze it point by point. Remember, that in order to understand better the Pattern of the technical analysis, you should know how the Trend Lines and Resistances/Supports work (For this reason we suggest you to read: What is a Trend and what are Trend Lines; Resistance and Supports ).

Features of Broadening Formation

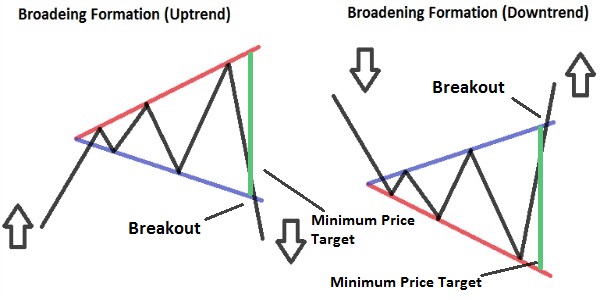

– When it occurs: Pattern that occurs mainly in an Uptrend and that is usually a Reversal Pattern; but it can also occur in a Downtrend, or it can also be a Continuation Pattern.

– The two parallel lines are divergent.

– The Highs are progressively higher while the Lows are gradually lower.

– It may seem similar to the symmetrical triangle, but in this case the lines are divergent rather than convergent.

– Breakout: to know if the Pattern will be bullish or bearish (So to know in which direction the Prices will go after the Pattern) you have to wait for the Breakout. For a confirmation, you can wait for the Pullback or you can use an Oscillator/Indicator or a Candlestick Pattern.

– Minimum Price Target: you have to measure the width of the Pattern, and then project it from the Breakout point in the direction in which the Prices are moving.

![Binance Review: How the Crypto Exchange Works [2024]](https://www.feedroll.com/wp-content/uploads/2024/03/binance-trading-100x100.png)