How does the turbulence on Wall Street affect Main Street? What can you do to prepare your portfolio for the whipsaw activity in the global markets?

As a trader, or an investor, you have likely held your breath in recent weeks as markets dropped precipitously. The December highs of the NASDAQ, Dow Jones, and S&P 500 index have given way to the February blues. At the time of writing, markets have regained a modicum of respect, by surging several percentage points after the disastrous showing at the start of the month. Stocks are generally down across the board over the past 1 month. The Dow Jones Industrial Average has retreated 5.05%, the S&P 500 index is down 4.91%, and the NASDAQ Composite Index is down 3.90%. These figures are testament to the selloff that took place recently, but leading analysts remain optimistic that there is value to be had in current markets. Olsson Capital trading expert, Samuel Belvedere Sr. believes that we need to understand the fundamentals of the markets before acting on emotion:

“We’ve seen this story playing out many times before. Equities markets rally, stutter, and everybody wants to bail. However, we should look clearly at the longer-term performance of US bourses for a window into the likely future performance. The Dow, NASDAQ, and S&P 500 index have shattered expectations since the election of Pres. Donald Trump. Several factors are going to play favourably into the performance of equities markets, notably strong jobs growth, low unemployment, a fundamentally sound economy, and most importantly the tax overhaul. By December 31, 2018, companies will be subject to new tax legislation. From well over 35%, corporate taxes will be cut to 21%. Personal exemptions will be doubled, putting more money into the pockets of Americans than ever before.

These measures cannot be discounted when we are talking about the strategic direction of equities markets. For these reasons, and many others, we have to maintain focus and remain optimistic. If you were a betting person, you would go long with call options on bank and financial stocks. There are many reasons why bank stocks are the go-to investment for 2018. Consider the following: the Fed has indicated at least 2-3 rate hikes in 2018. Every time interest rates rise, banks become more profitable. There is relaxed regulation vis-à-vis Dodd Frank and capital cushions required of banks. Finally, the tax overhaul will ensure that banks get to keep more of their profits and will be able to re-invest in real estate, and other lucrative investments.”

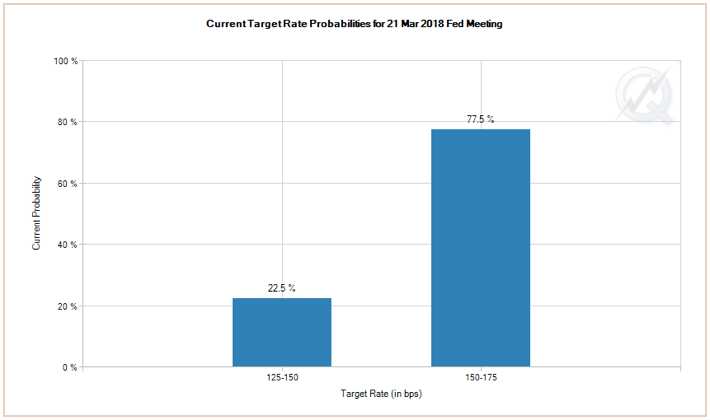

What Is the Probability of Rate Hikes in 2018?

The CME Group FedWatch tool stays abreast of the latest development of rate hike probabilities in the US. The next meeting of the Fed FOMC takes place on Wednesday, 21 March 2018. Based on the current analysis, there is a 77.5% likelihood of interest rates rising by 25 points. This will mean that the rate (FFR) will rise to 1.50% – 1.75%. While markets will typically price this likelihood into current levels, it will still result in a jolt for the USD. After that, there are additional Fed FOMC meetings on May 2, June 13, August 1, September 26, November 8, and December 19. It is highly likely that there will be 3 rate hikes this year.

This bodes well for the USD which currently is trending bearish based on the DXY (US Dollar Index). A stronger USD means that US exports will be relatively more expensive, but the US will be able to import more for less. Dollar-denominated commodities will likely take a beating with a stronger greenback, having a mixed effect on the financial markets. The current level of the US dollar index is 89.63, marginally higher than the 52-week low of 88.44. For the year to date, the DXY is down 2.71%, indicating that the US dollar has faltered against a basket of 6 currencies including the EUR, GBP, CHF, CAD, JPY and SEK. As a Forex trader, you would probably want to go long on the USD and related pairs with the greenback.

![Binance Review: How the Crypto Exchange Works [2024]](https://www.feedroll.com/wp-content/uploads/2024/03/binance-trading-100x100.png)