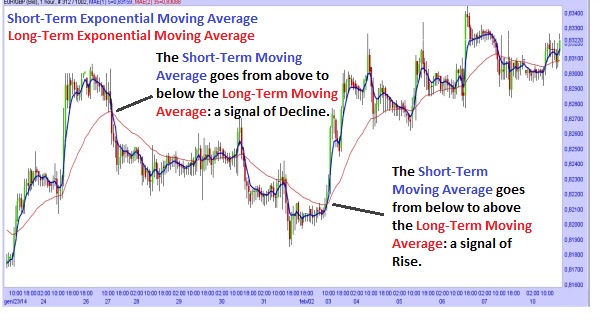

Using multiple Moving Averages: a method to use the Moving Averages, is to insert two moving averages on the same chart to obtain some signals from them. The two moving averages have to be similar but with different Period: a moving average must be for the short-term, the other must be for the long-term.

Using Multiple Moving Averages

So for example, we could choose a simple moving average with the Period of 15 days and a simple moving average with the Period of 50 days; or an exponential moving average with the Period of 50 days and an exponential moving average with the Period of 200 days. Both the Moving Averages have to be applied on the same chart, and when they will cross each other, we will obtain the signals.

As you can see from the image above, if the short-term moving average goes from below the slow moving average to above it, then we will expect an imminent rise in prices. Whereas, when the short-term moving average goes from above the slow moving average to below it, then we will expect an imminent decline in prices.

Finally, remember that we will choose the Period of the two moving averages depending on what type of movements we want to analyse: If we want to follow short-term movements of the Prices (days or Weeks), we will choose short Periods for the two moving averages (For example, 5 days and 35 days for the Exponential moving average of short and long term). If we want to follow long-term movements of the Prices (weeks or months), we will choose long periods for the two moving averages (For example 50 days and 200 days for the Simple moving average of short and long term).

![Binance Review: How the Crypto Exchange Works [2024]](https://www.feedroll.com/wp-content/uploads/2024/03/binance-trading-100x100.png)