Dropbox (DBX) is a publicly listed stock currently trading on the NASDAQ. At the time of its IPO listing, it was trading at $30 + per share, some 43% higher than the IPO price of $21. For a tech-savvy investor, Dropbox offers many benefits. For starters, it’s one of a few tech stocks that has a well-established history, and millions of paying subscribers. Unfortunately, many of the big-name IPO listings have not gone over so well in recent years, leading to a degree of caution among traders.

In March 2017, Snapchat went public, through its parent company Snap Inc. (SNAP). Unfortunately for investors eager to snap up this stock, it has performed abysmally since inception. The 52-week high of Snapchat is $23.57, and the low is $11.28. The stock is currently trading around $14.31 per share. Technology stock investors will be cautious about plowing their funds into another Snapchat debacle.

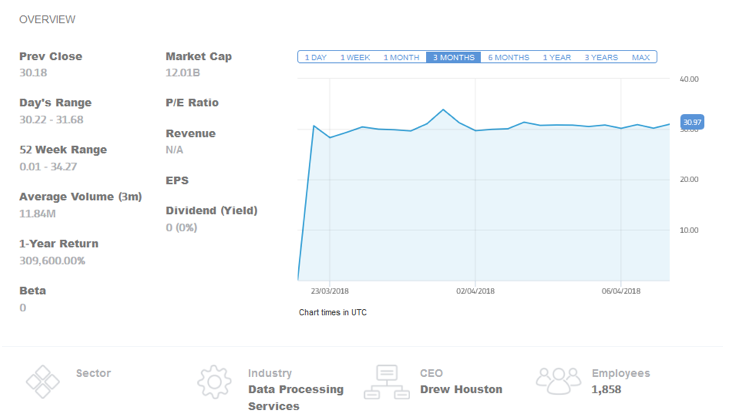

However, Dropbox (DBX) has successfully held its value since listing on 23 March 2018. At the time, Dropbox (DBX) was priced at $29.98 per share and has consistently maintained that value with little fluctuation to the downside. As at April 10, 2018, DBX was trading at $31 per share, with significant optimism among analysts. Consider that this stock has a recommendation rating of 1.0 on a rating scale where 1.0 represents a strong buy and 5.0 represents a sell. That the current price already exceeds the 1-year target estimate of $22 is notable.

According to analysis, there was a x25 oversubscription for the IPO, leading to a significant run on prices. In February 2018, the company announced that it had 500 million registered users, and 11 million paying users. This company offers cloud storage services to clients, and it generated revenues of approximately $1 billion, with a reported net loss of $111.7 million in 2017, and $210.2 million in 2016. Yet despite these net losses, the company exploded out of the blocks in March.

The Dropbox share price is a fair representation of a bullish stock. This cloud storage company and file sharing provider had a company valuation of $8 billion at its IPO – significant by any admission. This stock is fundamentally sound, given the company’s pioneering abilities, even when its main competitors are Google and Amazon. There are at least 4 categories of investors who are interested in Dropbox stock, including tech-savvy investors, day traders & swing traders, cloud computing aficionados, and investors with an eye to the future.

Given all the public interest in Dropbox, it comes as no surprise that the stock price is performing well. The lack of profitability for the company in recent years is an area of concern, but it also presents alternative trading opportunities with derivatives instruments, and futures contracts. The future profitability of this company depends on its ability to compete against Google and Amazon, as well as its own performance via quarterly reports. Dropbox offers intuitive copy/paste functionality with free accounts, and ongoing innovation.

This is what keeps the company competitive and will ultimately lead to long-term success.

The Final Word

An interesting statistic was listed by US News recently: 80% of the biggest tech IPOs dropped between 25% – 71% 1 year after they started trading. Most of the stocks reported massive gains on their first day, and they plunged spectacularly as investor enthusiasm waned. Additionally, once that investor lockup session expires many investors cash out and collect their profits. Like all newly launched IPOs, caution is advised for DBX investors. Stock markets are displaying volatility, and investors have little appetite for poor performers.

![Binance Review: How the Crypto Exchange Works [2024]](https://www.feedroll.com/wp-content/uploads/2024/03/binance-trading-100x100.png)