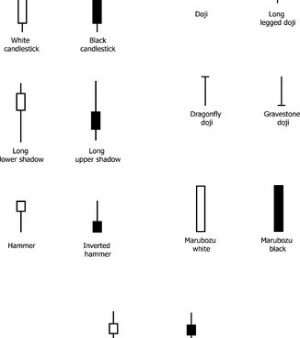

For a better understanding of this article, you should already know what Japanese Candlesticks are and all their features; for this reason, we suggest you to read this introductory article to Japanese Candlesticks: Japanese Candlestick Chart ( So that you can understand also the Ratings given to the Candlestick Patterns for the “quality” of the signal and for their frequency to “appear” on Charts).

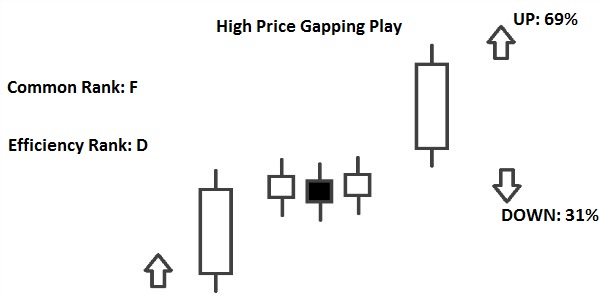

Let’s analyse now the following Candlestick Pattern: “High Price Gapping Play”.

High Price Gapping Play

– Normally it should be a signal of continuation of the current Trend.

– It occurs during an Uptrend; confirmation is required by the candles that follow the Pattern.

– The First Candle is long and white.

– The Second, Third and Fourth Candle, have a short Real Body and they are near the level of the High of the First Candle.

– The Fifth Candle is long and white, that gaps up from the Previous Candle.

– The “Sideways” Period, can contain up to Eleven Candles (Not necessarily Three Candles); these candles are the Spinning Tops (That have short Real Body).

![Binance Review: How the Crypto Exchange Works [2024]](https://www.feedroll.com/wp-content/uploads/2024/03/binance-trading-100x100.png)