For a better understanding of this article, you should already know what Japanese Candlesticks are and all their features; for this reason, we suggest you to read this introductory article to Japanese Candlesticks: Japanese Candlestick Chart ( So that you can understand also the Ratings given to the Candlestick Patterns for the “quality” of the signal and for their frequency to “appear” on Charts).

Let’s analyse now the following Candlestick Pattern: “Fry Pan Bottom Pattern”.

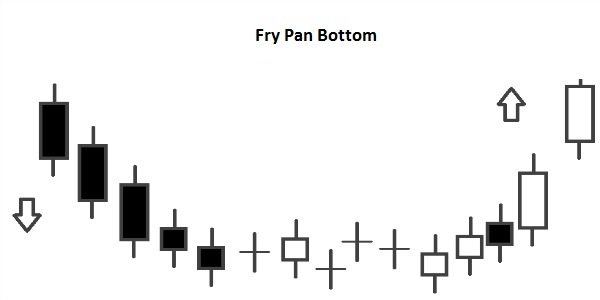

Fry Pan Bottom Pattern

– Normally it should be a signal of Bullish reversal of the current Trend.

– It occurs during a Downtrend; confirmation is required by the candles that follow the Pattern.

– The Pattern starts during a Downtrend, then it becomes a “Sideways” Trend (That represents the indecision of the Markets); at the end of the Pattern, there is a reversal in the direction of the Trend and it becomes an Uptrend.

– This Pattern is quite rare; is important that there is a Gap Up after the “Sideways” Trend and just before the start of the Uptrend (To obtain a further confirmation of the reversal of the Trend, as the Pattern suggests).

![Binance Review: How the Crypto Exchange Works [2024]](https://www.feedroll.com/wp-content/uploads/2024/03/binance-trading-100x100.png)