The TRIX indicator (Triple Exponential Average), shows the level of percentage variation of a triple Exponential moving average, built on the closing price of an Asset.

General Features of the TRIX Indicator

– Is used to filter the “noises” of price movements; the signals from the TRIX are similar to those of the MACD.

– The TRIX is used to identify divergences between prices and indicator, Overbought/Oversold situations and to obtain signals of rise or decline in Prices.

– TRIX oscillates around the Zero Line.

– The standard Period of the TRIX is 15 days; If you want signals for the short-term, you should change the Period to 5 days (The Signal Line EMA always to 9 days). If you want long-term signals, you should change the period to 45 days (The Signal Line EMS always to 9 days).

How to Interpret the signals from the TRIX Indicator

– Zero Line: When the TRIX breaks above (Goes from below to above) the zero line, it’s a signal of rise in Prices. Whereas, when the TRIX breaks below (Goes from above to below) the zero line, it’s a signal of decline in Prices.

– Signal Line: you can add an exponential moving average (EMA) with the Period of 9 days of the TRIX (If the TRIX is set with the Standard Value of 15 days) in order to obtain other signals. In fact when the TRIX breaks above (Goes from below to above) the EMA, it’s a signal of rise in Prices. Whereas, when the TRIX breaks below (Goes from above to below) the EMA, it’s a signal of decline in Prices.

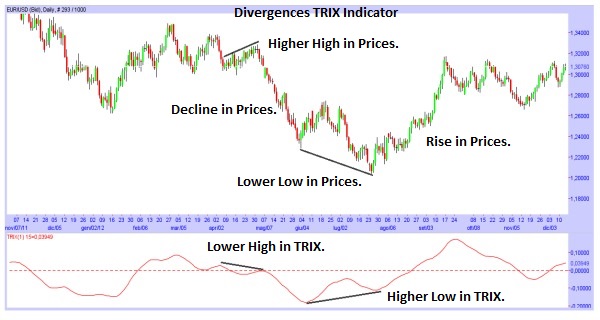

– How to interpret the Divergences between TRIX and Prices: Divergence means that on the Chart there is a certain movement, while the TRIX does the opposite movement. There are two different types of Divergence.

There is the Bullish Divergence, signal of a possible Rise: there is a new Lower Low in the Prices while there is a new Higher Low in the TRIX (So in the Prices there is a decline, while in the TRIX there is a rise); that is a signal of a possible Rise in the Prices.

There is the Bearish Divergence, signal of a possible Decline: there is a new Higher High in the Prices while there is a new Lower High in the TRIX (So in the Prices there is a rise, while in the TRIX there is a decline); that is a signal of a possible Decline in the Prices.

![Binance Review: How the Crypto Exchange Works [2024]](https://www.feedroll.com/wp-content/uploads/2024/03/binance-trading-100x100.png)