The Rate of Change, also known as ROC, is an Indicator that measures the percent change in price from one period to the next. The differences of the changes are measured in percentages, so that can be compared with other values.

General Features of the Rate of Change (ROC)

– The Standard value for the Period of the ROC, for the short-medium term trading is 12 days in case of short and 25 days in case of medium. While for the long-term trading, is 125 days or 250 days.

How to Interpret the Signals from the Rate of Change (ROC)

– Values above the zero, mean a possible rise in Prices; Values below the zero, mean a possible decline in Prices.

– Zero Line: when the ROC breaks above (Goes from below to above) the Zero Line, it is a signal of a rise in Prices; whereas, when the ROC breaks below (Goes from above to below) the Zero Line, it is a signal of a decline in Prices.

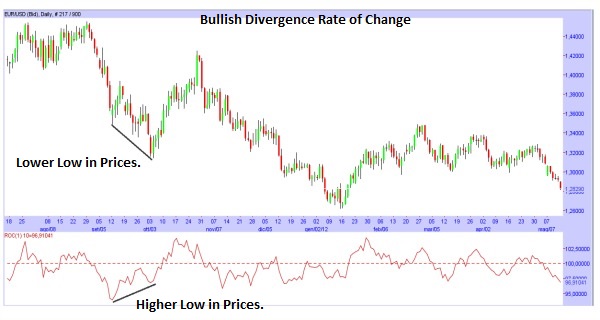

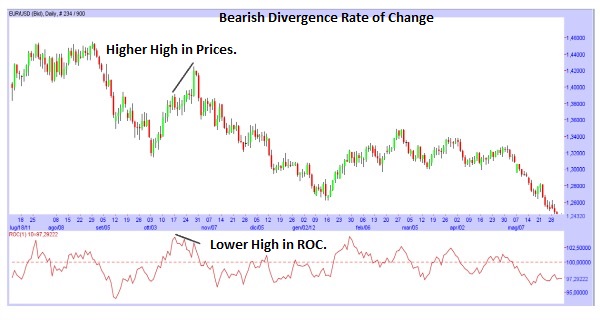

– Using the Divergences: when there is a divergence between the ROC and the Prices, it is a signal of a possible future reversal of the Trend.

![Binance Review: How the Crypto Exchange Works [2024]](https://www.feedroll.com/wp-content/uploads/2024/03/binance-trading-100x100.png)