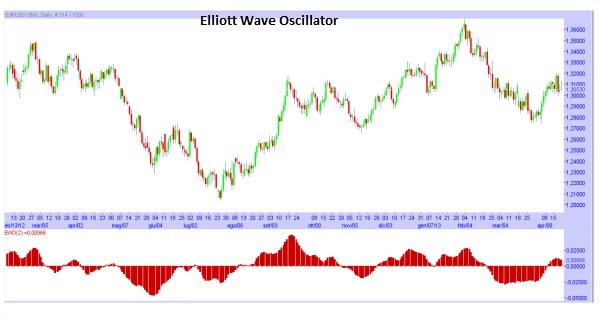

The Elliott Wave Oscillator has been created to help in the process of identification of the Elliott’s Waves and of the Trends. Thanks to this Oscillator, it’s easier to understand in which moment of the Elliott’s Waves we are and to identify the current Trend.

For a better understanding of this article, you should read also the article about the Theory of the Elliott’s Waves (Elliott Wave Theory).

How to Interpret the signals from the Elliott Wave Oscillator

– The highest values of the EWO are during the Third Wave.

– The First Wave it often begins whit a Divergence between the Prices and the EWO: when there is a new Higher High in the Prices while there is a new Lower High in the EWO (So in the Prices there is a rise, while in the EWO there is a decline); or when there is a new Lower Low in the Prices while in the EWO there is a new Higher Low (So there is a decline in the Prices, while there is a rise in the EWO). Both are signal of a possible reversal in the current Trend, reversal from which it starts the First Wave.

– After the First Wave, there will be a correction (Can be a rise or a decline, depending on which is the current Trend): that is the Second Wave.

– After the Second Wave (That is a rise or decline, depending on the type of the Previous Wave) there will be the Third Wave: the Third Wave will be a rise (If the previous wave is a decline) or a decline (If the previous wave is a rise), that will make a new High or Low (Depending by the case) both in the EWO that in the Prices. The length of the Decline/Rise of the Third Wave is between the 100% and 161% of the length of the First Wave.

– After the Third Wave, there will be a correction (Can be a rise or a decline, depending on the Previous Wave): that is the Fourth Wave.

– Then there will be the Fifth Wave: there will be a new Higher High or a new Lower Low while in the EWO there will be a ne Lower High or a new Higher Low, creating a Divergence between the Prices and the EWO from which will begin the reversal of the current Trend and the Corrective Wave (Corrective Wave that is composed by three Movements).

– Normally when the Fourth Wave occurs, the EWO will cross the Zero Line or go near the Zero Line.

![Binance Review: How the Crypto Exchange Works [2024]](https://www.feedroll.com/wp-content/uploads/2024/03/binance-trading-100x100.png)