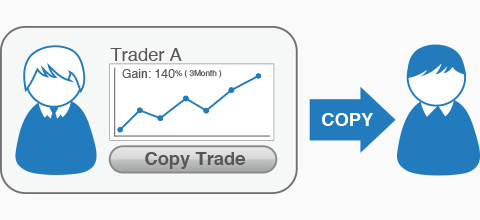

Copy trading is an innovative investment trick that helps you wade into the forex trading world. Some people usually call it social trading, so any confusion is warranted. But the two are not so different that the meaning is lost when the terms are used interchangeably.

Simply put, copy trading allows the investor to automatically copy every trade that is executed by a more experienced trader. The main goal here is to mirror the veteran’s performance in your own personal account.

Unlike an investment fund, the money invested in copying a trader remains in the control of the investor. You don’t hand over your funds to the hands of the other trader. Instead, you are simply replicating the moves of another trader. This means that you can choose to stop at any time and your investment will stay in your brokerage account.

To start copy trading, all you have to do is open a personal trading account. Then, with the help of a copy trading platform, you can then connect your account to the veteran that you chose to follow. Simply put, copy trading lets you delegate the management of your personal trading account to one or more experienced traders.

The Main Players in a Copy Trading Platform

There are a few key elements in copy trading. While there are lots of versions and nuances to the services a copy trading platform will offer, it all boils down to four basic components:

1. The Market

Since copy trading is a financial instrument, it makes sense that the whole structure is based on a financial market. In this case, the backbone to copy trading has always been – and still is – the foreign exchange (forex) market. This is because forex has a great degree of liquidity.

However, the market has grown to encompass other financial instruments. Today, these include stocks, commodities, indices, interest rates, and Bitcoin.

2. The Broker

The broker is another fundamental and ever-present element. That’s because you can’t invest in most markets without one. When it comes to copy trading, you will need a broker to set up a trading account. Then, you can use this account to receive operating signals from your preferred copy trading platform.

That’s just one way to do it. You might also find a broker who also operates as a trading platform themselves. In this case, you will have to choose an appropriate broker who offers this service and open a trading account. Even a demo account works in this case.

3. The Signal Provider

This refers to the trader that you have chosen to copy. Obviously, your choice has to have some sort of logical rational backing it up. That’s why most platforms will let you observe and analyze any relevant data on a trader’s performance.

The information provided from one platform to another. Some let you evaluate a particular strategy before moving forward with it. Others will simply provide a record of the signal provider’s performance from the moment they subscribed to the platform. This creates statistical data records that will help you make the right choice.

4. The Investor

In the world of social trading platforms, the investor is also known as a follower. By investing in a copy trading strategy, you basically become a fund manager. You decide your fund’s objectives, define the risks that you’re willing to take, and identify the best assets to build it. In this case, your main asset will be your signal provider.

Many rookies make the mistake of believing that the only important thing they have to do is find the right traders to copy. While this can be true to some extent, you still have a lot of responsibility for your fund. If you don’t make the right choices, you will end up burning through your fund – even if you follow the best traders.

Choosing the Right Trading Platform

One of the most important decisions you can make for your fund is choosing the right trading platform to subscribe to. In this case, your best bet is to join the RealTrader Community.

Here, you get access to some of the best veteran traders with extensive experience in forex copy trading. You’ll also find a helpful forum for like-minded traders, as well as in-depth analyses to help you make the right trading choices.

The Final Word

Copy trading might be a pretty straightforward affair, but it takes a lot of time and hard work to be successful here. The greatest investment you can make is one in yourself by gaining all the knowledge and skill you need to start generating profits on a continuous basis.

![Binance Review: How the Crypto Exchange Works [2024]](https://www.feedroll.com/wp-content/uploads/2024/03/binance-trading-100x100.png)