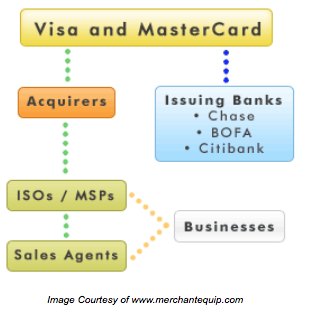

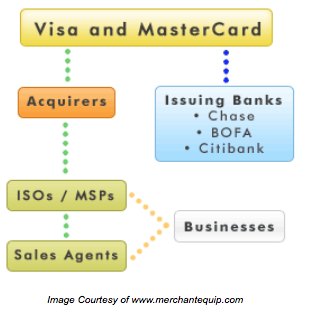

A Merchant Service Provider is a term that covers 3rd party processors, banks, and other entities that offer individuals and businesses the services and products necessary to accept credit cards, debit cards and other types of electronic payment. MSPs such as Dharma Merchant provide valuable services to small business owners. How should you choose a merchant service provider? Beginners often make their choice based on price.

Although competitive rates are important when choosing an MSP, you should consider other factors as well.

With so many options in the market, choosing an MSP can be a daunting task. Not all companies are equal, and a quick search will reveal plenty of merchant accounts from many MSPs. These five tips will help you to select the right one for your business:

Know your fees

Different companies offer different fees, but you need to make sure that they are reasonable. However, you need to be wary of fees that are too reasonable. If a service provider offers lower fees than others do, proceed with caution. You might end up being hit by hidden fees later. Moreover, they might be charging lower fees due to bad customer service. You also need to know the reserve policy – fees retained by processors as insurance against chargeback concerns and risky clients. Make sure you choose a provider with fair reserve demands.

Ask questions

A well-informed small business owner always asks the right questions. Here are the points to consider when choosing merchant services:

- How is the customer service? The provider should have a toll-free number to address customer concerns. Customer service should be available on a 24-hour basis to deal with any concerns that arise.

- What is their track record? Find the answer to this question by checking Better Business Bureau. If the company’s record is filled with complaints, you should dismiss it. This will save you from future problems.

Avoid banks

When making your choice, it is best to stick with actual merchant service providers and avoid banks. There are no real advantages to using banks. In this digital age, banks lack the technology to provide top-quality merchant services: especially when it comes to wireless activity and ecommerce.

No caps

Ensure that your provider does not cap your monthly volume. This would get in the way of your plans when you cannot process any credit card sales. This happens when there is a cap, and your business can suffer as a result. If you do not confirm whether your MSP imposes caps ahead of time, you will be in trouble. Look for an account that gives you monthly flexibility – it would be worth the effort.

Find out as much as you can

The importance of asking the right questions cannot be overemphasized. Although you might not like the grilling part, you will be happy in the end. First, find out how long the MSP has been in business. This will help you to choose the provider that meets your needs best. While a brand new business might offer new technology, their customer service might be lacking. Second, find out the accuracy of their records. Former clients can give you the answer to this question. Choose a provider that keeps accurate deposit reports and statements.

When armed with these tips, you will make a more informed decision about the right MSP for your small business. Whatever you do, make sure you do proper research on the merchant service providers that you are considering. This will prevent you from making an ill-informed decision that could hurt your business later.

![Binance Review: How the Crypto Exchange Works [2024]](https://www.feedroll.com/wp-content/uploads/2024/03/binance-trading-100x100.png)

![Dukascopy Broker Reviews, Pros & Cons [2024]](https://www.feedroll.com/wp-content/uploads/2024/03/Dukascopy-europe-100x100.jpg)

![Plus500 Reviews: How it Works, Pros & Cons! [2024]](https://www.feedroll.com/wp-content/uploads/2024/03/plus500_-100x100.jpg)